Fund Focus

Carmignac P. Unconstrained Credit: the Fund Manager's thought

In the third quarter of 2020, Carmignac Portfolio Unconstrained Credit posted a performance of +4.12% versus a +2.14% gain for its reference indicator, generating a +1.98% outperformance. For the first nine months of the year, the Fund returned a performance of +4.30%, while its reference indicator is down -0.02%.

Life is far from having gotten back to what it was before Covid 19, but the third quarter of 2020 was much closer to normality than the first half of the year. This is also true for credit markets which, gradually, are becoming driven again by the long term trend which had prevailed for the past years: investors are anxious, fearful of credit accidents (be it downgrades or defaults) while an abundance of capital remains allocated to the asset class.

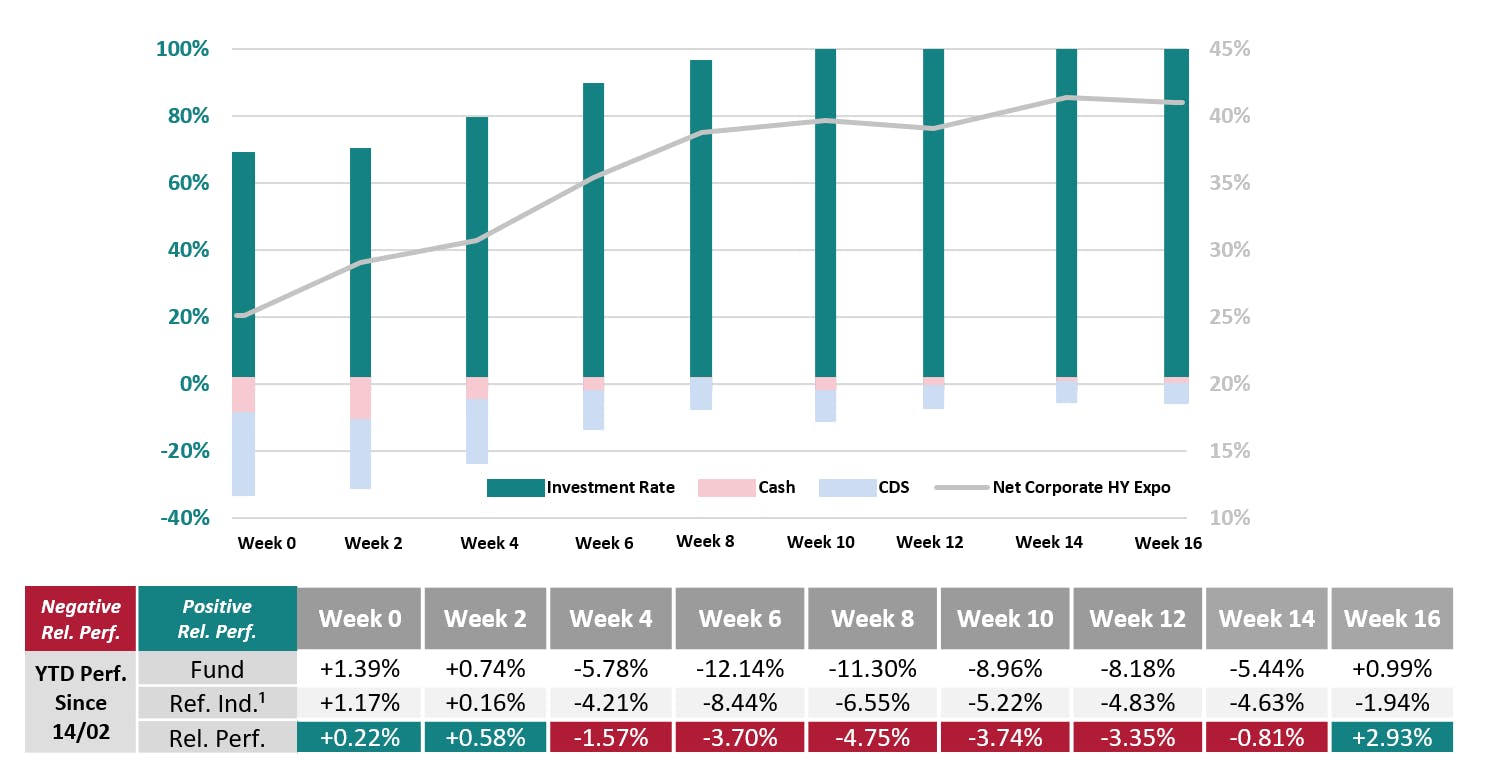

Managing Carmignac P. Unconstrained Credit Through a Market Dislocation (%)

Source: Carmignac as at 05/06/2020. A EUR Share class ¹75% ICE BofA Euro Corporate Index (ER00) and 25% ICE BofA Euro Hight Yield Index (HE00) calculated with coupons reinvested and rebalanced quarterly.Past performance is not necessarily indicative of future performance.The return may increase or decrease as a result of currency fluctuations. Performance are net of fees(excluding applicable entrance fee qcuired to the distributor)¹CCR= Carmignac P. Unconstrained Cred,*CDS=Credit Default Swap.

This environment bears a lot of similarities with the first half of 2016 or, closer to us, the first half of 2019. We expect the coming months to be similarly fertile for bond pickers. This is not to say it will be a smooth or easy ride. We are already seeing a sharp rise in credit rating downgrades and defaults and we expect more accidents in the next quarters.

-

Central bankers can help sound businesses refinance themselves and pay lower interest expenses but they cannot save disrupted, structurally unprofitable business models. It is often said that defaults are caused by the economic environment. While there is a correlation, we do not believe there is much causality. Issuers rarely default on their debt because GDP growth turned out one or two percentage points lower than expected.

-

They default because their business models have been disrupted or competed away and/or because investors have not been careful in their due diligence and analysis when assessing how much debt they can bear.

Recessions only lower the willingness and ability to kick the can down the road. Hence, the measures taken to fight Covid19 will have an important impact on default rates but there would have had a high occurrence of defaults in the coming years even without this virus. It will mostly act as a catalyst, precipitating defaults which would have occurred in two or three years.

This is why we always keep in perspective the multiyear outlook of a full credit cycle when picking investments and deciding how much risk we want to put in the portfolio - while credit markets tend to price only short-term default rates, which is akin to driving a motorbike looking only one meter in front of the handlebar.

We are excited by the opportunities we see ahead. During the past months, the fund has benefited from high quality credit repricing to a more normal level. Yet we still have in our portfolio many bonds from solid businesses with sound business models, good balance sheets and continuous access to liquidity, yielding far in excess than their fundamental cost of risk, even under the assumption of a painfully slow economic recovery.

We also see a lot of excess spread in Collateralized Loan Obligations (“CLOs) tranches, with very limited fundamental risk - we would need much more pessimistic assumptions to break those tranches than what is needed to break other asset classes. As a result, we believe the risk-adjusted yield of the fund is very attractive at the moment. Beyond our current portfolio, as we wrote above, we expect the upcoming wave of accidents will keep risk aversion high and create numerous investment opportunities, long and short.

Carmignac Portfolio Credit A EUR Acc

| 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 |

2024 (YTD) ? Year to date |

|

|---|---|---|---|---|---|---|---|---|---|---|---|

| Carmignac Portfolio Credit A EUR Acc | - | - | - | +1.79 % | +1.69 % | +20.93 % | +10.39 % | +2.96 % | -13.01 % | +10.58 % | +4.84 % |

| Indice di riferimento | - | - | - | +1.13 % | -1.74 % | +7.50 % | +2.80 % | +0.06 % | -13.31 % | +9.00 % | +1.18 % |

Scorri a destra per vedere la tabella completa

| 3 anni | 5 anni | 10 anni | |

|---|---|---|---|

| Carmignac Portfolio Credit A EUR Acc | +0.33 % | +3.43 % | - |

| Indice di riferimento | -1.61 % | -0.04 % | - |

Scorri a destra per vedere la tabella completa

Fonte: Carmignac al 28/06/2024

| Costi di ingresso : | 2,00% dell'importo pagato al momento della sottoscrizione dell'investimento. Questa è la cifra massima che può essere addebitata. Carmignac Gestion non applica alcuna commissione di sottoscrizione. La persona che vende il prodotto vi informerà del costo effettivo. |

| Costi di uscita : | Non addebitiamo una commissione di uscita per questo prodotto. |

| Commissioni di gestione e altri costi amministrativi o di esercizio : | 1,20% del valore dell'investimento all'anno. Si tratta di una stima basata sui costi effettivi dell'ultimo anno. |

| Commissioni di performance : | 20,00% quando la classe di azioni supera l'Indicatore di riferimento durante il periodo di performance. Sarà pagabile anche nel caso in cui la classe di azioni abbia sovraperformato l'indice di riferimento ma abbia avuto una performance negativa. La sottoperformance viene recuperata per 5 anni. L'importo effettivo varierà a seconda del rendimento del tuo investimento. La stima dei costi aggregati di cui sopra include la media degli ultimi 5 anni o dalla creazione del prodotto se inferiore a 5 anni. |

| Costi di transazione : | 0,43% del valore dell'investimento all'anno. Si tratta di una stima dei costi sostenuti per l'acquisto e la vendita degli investimenti sottostanti per il prodotto. L'importo effettivo varierà a seconda dell'importo che viene acquistato e venduto. |

* Reference Indicator: 75% ICE BofA Euro Corporate Index (ER00) and 25% ICE BofA Euro High Yield Index (HE00) calculated with coupons reinvested and rebalanced quarterly. 2017 Performance : since the launch of the fund on 31/07/2017. Performance of the A EUR acc share class. Past performance is not necessarily indicative of future performance. The return may increase or decrease as a result of currency fluctuations. Performances are net of fees (excluding possible entrance fees charged by the distributor).

Carmignac Portfolio Credit A EUR Acc

Periodo minimo di investimento consigliato

Rischio minimo Rischio massimo

CREDITO: Il rischio di credito consiste nel rischio d'insolvibilità da parte dell'emittente.

TASSO D'INTERESSE: Il rischio di tasso si traduce in una diminuzione del valore patrimoniale netto in caso di variazione dei tassi.

LIQUIDITÀ: Le puntuali irregolarità del mercato possono ripercuotersi sulle condizioni di prezzo che inducono il Fondo a liquidare, aprire o modificare le posizioni.

GESTIONE DISCREZIONALE: Le previsioni sull'andamento dei mercati finanziari formulate dalla società di gestione esercitano un impatto diretto sulla performance del Fondo, che dipende dai titoli selezionati.

L'investimento nel Fondo potrebbe comportare un rischio di perdita di capitale.